Thursday Nov 7, 2024

November 7, 2024 Franconia Heritage Restaurant

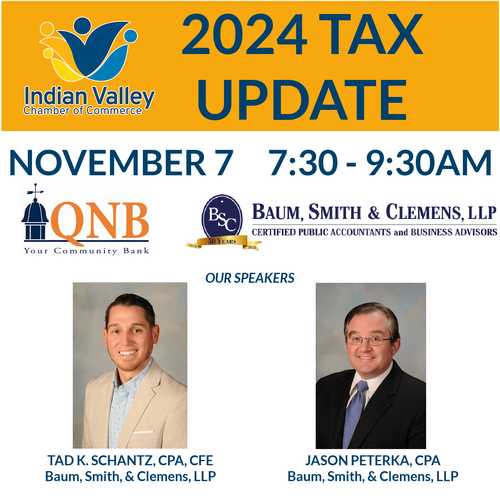

I V Chamber Please join us for our annual Year-End Tax Update. This gathering at the Franconia Heritage Banquet and Conference Center offers a prime opportunity for networking and knowledge sharing. Thank you to our sponsors, QNB Bank and Baum, Smith & Clemens, LLP. Continental breakfast will be provided. This is a free event, but you must register to attend. Our Presenters: .jpg)

2024 Tax Update

Date and Time

7:30 AM - 9:30 PM EST

7:30 - 9:30AMLocation

508 Harleysville Pike

Telford, PA 18969Contact Information

Send Email

Description

Jason K. Peterka, CPA

Tax Manager

Jason joined the firm in 2018 after working for another local tax firm. With over 20 years of experience in the public accounting field, he assumed the role of Tax Manager. He is responsible for reviewing individual and business tax returns, tax research and performing extensive training for our staff. Besides review work, his tax experience also includes preparing individual, closely held businesses, nonprofit and trust returns.

Jason graduated from West Chester University with a Bachelor of Science degree in Accounting and has a Master of Science in Taxation from William Howard Taft University. He is a member of the American and Pennsylvania Institutes of Certified Public Accountants.

Jason resides in Mohnton PA, with his wife Erica and their two children, Ivy and Locke.

Tad K. Schantz, CPA, CFE

Partner

Tad joined the firm in 2006 after graduating from Bloomsburg University with a Bachelor of Science degree in Business Administration with a major in Accounting and a minor in Fraud Examination. He has been a CPA since 2009 and a Certified Fraud Examiner since January 2013. He is a member of the American and Pennsylvania Institutes of Certified Public Accountants and the Association of Certified Fraud Examiners.

As a partner, Tad serves as a tax and financial accounting resource to all members of the firm and to a diversified client base. With an emphasis on closely held businesses, his areas of expertise focus on the attestation, accounting, forensic accounting, tax planning, consulting, and preparation areas. Tad also serves as one of the firms’ leaders in the Audit and Accounting department. In this role, he is responsible for managing the resources of the A&A practice including, recruiting, training, budgeting, researching technical matters, compliance policies and procedures, and implementing accounting standards.

Outside of the office, Tad enjoys traveling with his family, physical activities (on both land and sea), household projects, baseball, and golf. He also volunteers as a coach in the Upper Perk Youth Baseball and Valley Soccer Club Organizations. Tad, his wife and two children reside in Pennsburg, PA

.jpg)